EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortization. It’s a way to evaluate a company’s earnings that’s a bit different from Net Income. Potential investors in, or acquirers of a manufacturing business may use EBITDA to evaluate their prospective investment. Therefore, improving EBITDA is directly correlated with improving the value of the business.

EBITDA as a benchmark is particularly useful for businesses that have a significant investment in hard assets, such as manufacturing businesses. In order to expand and grow, manufacturing businesses most often require the investment in new facilities and equipment. Many times this growth is financed through debt.

Depending upon the business location and the tax structure, the facilities and equipment will have a depreciation schedule associated with it. Depreciation is the way that companies account for the loss in value over time of an asset as it ages. Taxes rules are often set to allow for this loss in equipment value over time to be deducted from taxable earnings. For instance, companies that acquire capital equipment such as manufacturing machinery may be able to deduct from their taxable income a portion of the purchase price every year spread out over 10 years. Many tax jurisdictions allow for some accelerated depreciation, enabling this tax savings to happen faster, with the idea that reducing taxes for investing in new plant and equipment is an economic benefit to society and should be encouraged. The interest expense for the investment in business growth is often deductible as well.

Because of the impact on net income as it’s traditionally calculated from investments in growth through the expensing of interest and depreciation, it’s quite possible that a companys’ earnings can appear to actually decrease rather than increase after investing in new tangible assets and seeing the growth in revenue expected. You can see an example of how this might play out in a small business that has invested in new equipment here. In this example, although the planned increase in revenue occurred, it appeared from the earnings statement that the business value suffered from the investment in new machinery to allow the growth to happen, when it actually did not.

Although depreciation is useful to a business in order to gain a tax benefit from investing in facilities and equipment, it’s a ‘non-cash’ expense, that is, while a business may have paid for the equipment with cash, or may be paying a note that includes principal and interest, they don’t actually write a check for ‘depreciation’. This means that a business with significant investments in tangible assets and related deprecation may show a small or no profit, or even a loss in a given year and actually generate free cash flow. Free cash flow is what investors and owners like, and buy businesses for. So looking at a standard income statement may not give them the best indication of the value of a business to them.

Additionally, by backing out Interest in the EBITDA calculation, someone evaluating the business can estimate what the income statement and cash generation might start to look like in the future, once loans are paid off and cash generated is free from the interest expense.

So in manufacturing businesses, where a CFOs’ role is to maximize the net value of the business, EBITDA is an important metric that they’ll closely watch.

Of course, no self-respecting CFO would accept simply maximizing EBITDA at the expense of a healthy earnings statement as sources of capital beyond investors who might take equity in the business, such as banks who make loans instead, will be watching the standard earnings statement as well as EBITDA.

That means that as manufacturing companies are looking at opportunities to grow, and evaluating prospective investment profiles in capital equipment, they need to extract maximum value from every asset acquired.

This is where CFOs should be paying attention to IIoT technologies.

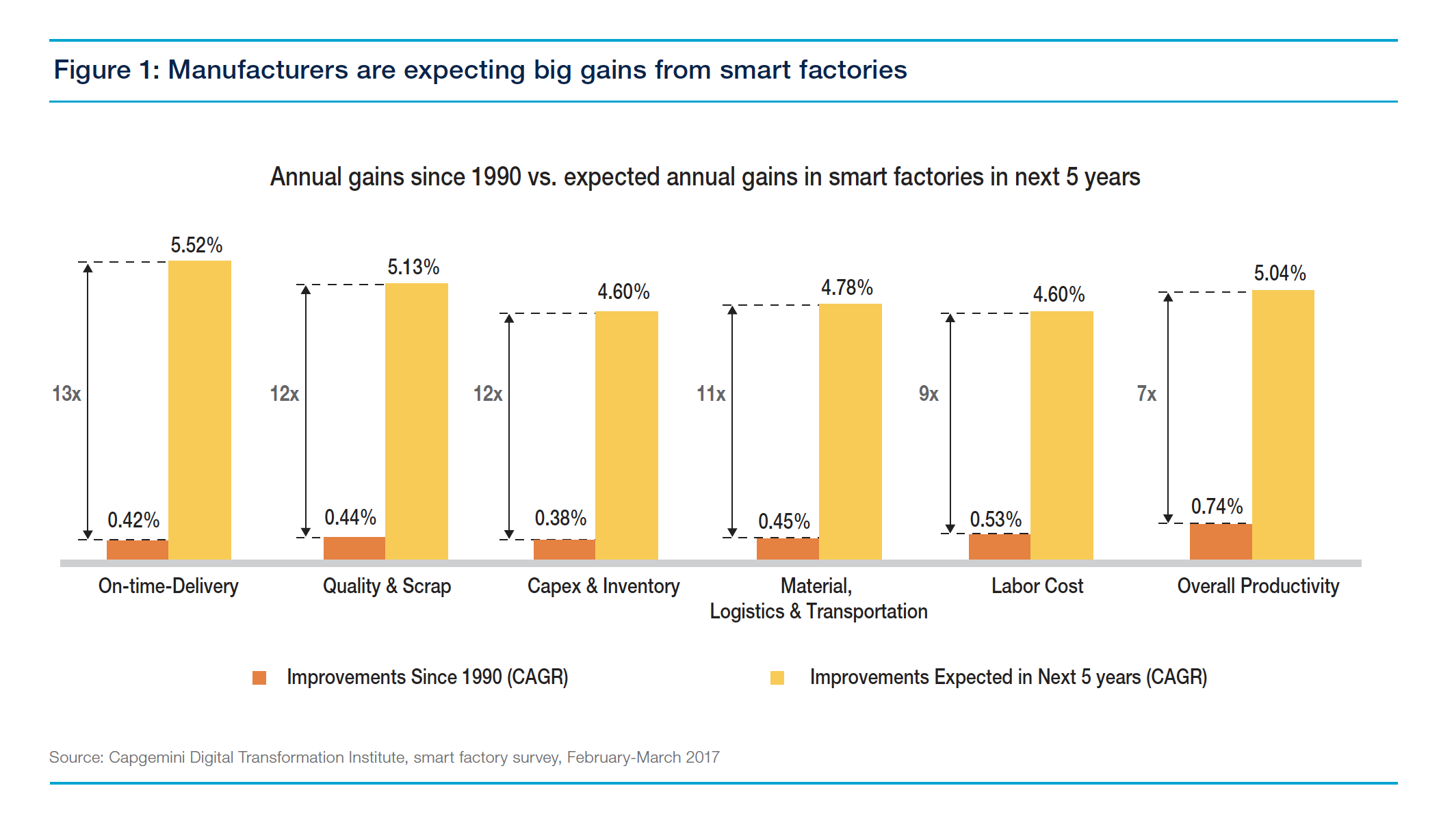

Investing in IIoT technologies help manufacturers extract the most productivity from every piece of machinery. Shrewd manufacturing CFOs will understand that IIoT technologies provide a form of leverage. Not the type of leverage that’s associated with taking on debt, but leverage in the fact that IIoT investments are force multipliers. By investing in the right IIoT technologies to connect to their newly acquired machinery, companies can increase productivity, reduce downtime, enable predictive maintenance which can lower overhead, decrease safety risk and expense, reduce rejects and more.

EBITDA can accurately show the performance of a manufacturing company overtime, and many analysts and investors see it as a preferred method for representing a company’s real earnings. Generally, EBITDA displays the amount of available cash flow a company possesses to either reinvest in itself or pay dividends. The efficiency of a company’s production activity is revealed and overall, EBITDA provides an accurate representation of a manufacturing company’s performance by removing many factors which can distort its actual value.

Are you a CFO interested in understanding how you can achieve all of these benefits and extract the most economic value from your investments in machinery? Book a demo with our sales team and learn more!