If you’re a food and beverage processor, like most manufacturers, you’re being squeezed on all fronts. Faced with challenges that include labor and raw material shortages, tightened regulations, and skyrocketing costs, companies like you are struggling to produce and price products to meet the demands of increasingly cost-conscious consumers and anxious stakeholders alike.

Fortunately for your industry, there will always be demand for what you produce. The key is to embrace innovation to navigate changing conditions and remain responsive to consumer demands - all while maximizing profitability. And for those willing to adapt and build resilience for the long term, there are solutions to the challenges you face.

The War for Talent

Spurred by the pandemic recovery, the U.S. Bureau of Labor Statistics (BLS), projects employment to reach 166.5 million by 2031. That figure adds roughly 3.7 million jobs to the 2019 prerecession level of 162.8 million. Unfortunately, a large majority of these jobs lie outside the manufacturing sector in areas such as healthcare, retail, leisure, and hospitality where pay has increased significantly to attract workers and/or keep up with minimum wages. Recruiting and retaining a new generation of talent remains a key challenge for food and beverage manufacturers.

Thankfully the industry is recognizing the importance of leveraging technology to transform its image from one of repetitive manual tasks to one where jobs can be centered on supervising and interacting with sophisticated equipment. Equipment that helps automate processes, accelerate production, maximize productivity, and boost profitability. Applying this technology for, with, and by workers helps to ensure success for manufacturers as well as attract and retain employees who are digital natives.

Rising Costs = Shrinking Margins

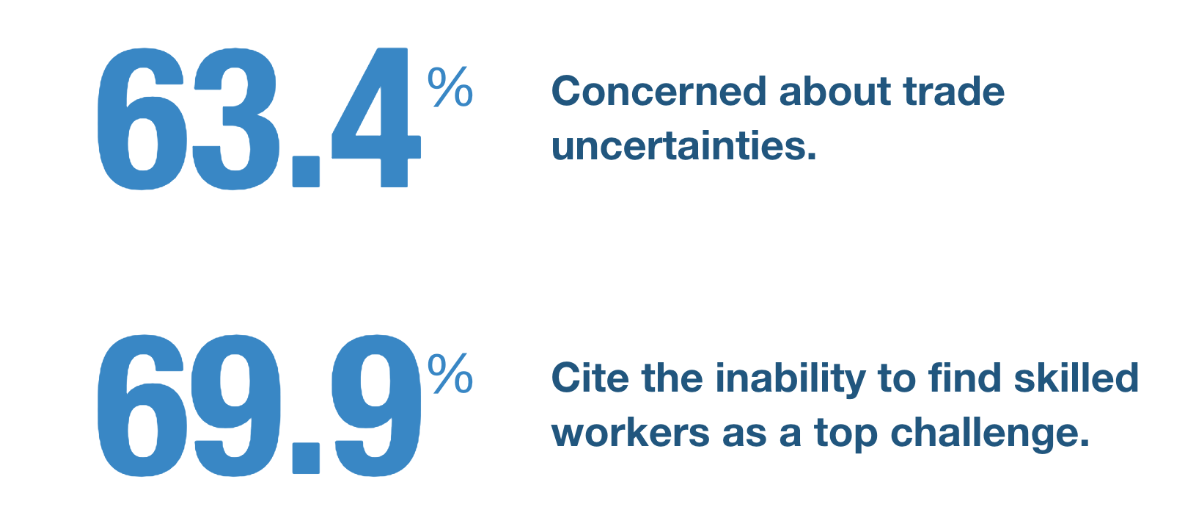

A recent survey conducted by TraceGains puts today’s food manufacturing environment into perspective:

· 58% of respondents rank supply chain disruptions as their single biggest challenge.

· More than 6 out of 10 business leaders said they have changed at least six product recipes or formulations in the last two years, with 37% having to modify 20 or more

· 9 out of 10 leaders said they’ve paid more for ingredients and materials in the last two years, and 65% have increased their prices.

Traditionally, rising costs have been passed along to the consumer in the form of price hikes and/or shrinkflation. However, such strategies are becoming increasingly risky as buyers are fighting back by reducing consumption, shopping less, and abandoning brand loyalty in favor of cheaper alternatives.

According to the Food & Beverage Winter Outlook 2023 report by consulting firm, RSM:

“Price hikes passed down to the consumer in 2022 have already influenced behavior, with U.S. households buying less food for at-home consumption than pre-COVID projections, despite spending more on food and beverage products than ever before.” The report goes on to say: “Middle-market food and beverage companies should expect the added competition for shelf space to bring about higher slotting fees and more promotions aimed at protecting market share from national and private label brands and penetrating new households.”

Today’s business intelligence solutions are keeping large-cap food and beverage manufacturers competitive throughout turbulent times by providing a real-time understanding of the impact of changes in pricing, consumer behavior, channels, and other market forces. Yet, while larger manufacturers have embraced such data tools, mid-market companies have been slow to invest.

Regardless of size, manufacturers are facing the hard reality that, business as usual is no longer an option. With margins down 10% across food and beverage processing in Canada and similarly, in the US, and inflationary and economic pressures showing no signs of improving, manufacturers must take action.

Those tempted to dismiss these warning signs would be well advised to reconsider as economic and consumer reporting confirm the trend to be more than a passing fad. This sentiment is echoed in a CMO Insights article which reports that, across the board, Chief Marketing Officers are reporting “appropriate pricing in the wake of soaring inflation and softness in the economy” as their leading challenge for the coming months.

Along these lines, any company relying on brand loyalty to weather the impending storm can put such thinking to rest. A recent consumer behavior survey from Deloitte finds that:

· 65% of retail shoppers say they will trade brands if prices are too high.

· 41% of shoppers expect the economy to weaken in 2023 (vs. 33% in 2021, 27% in 2020).

· Most categories across 2022 experienced significant movement between Private Label and branded products. Of these categories, 71.5% have gained in Private Label share.

With their backs against the wall, manufacturers are at a crossroads. Some are treading water by cutting staff, reducing shareholder expectations, and discontinuing non-core products to increase capacity for popular offerings. Others see this as an opportunity for transformative change through improved efficiency and lean practices.

Industry 4.0

Faced with challenging times ahead, forward-thinking manufacturers are taking a hard look at the business to achieve and maintain profitable margins. And for many, the answer can be found directly on the production floor.

Offsetting labor shortages, volatile production costs, supply chain disruptions, and similar threats with greater production efficiency allows companies like yours to continue meeting consumer price and quality expectations. This in turn translates into healthy profits. But focusing on improving efficiency isn’t new. Manufacturers have been striving for it since the industrial revolution.

Over the years, manufacturing technology has rapidly evolved enabling everything from monitoring production in real-time, to tracking energy and resource consumption, and identifying safety issues. And the pace of change is just getting faster. An article on Food Dive says that AI and ML are poised to play an even larger role for food and beverage manufacturers in 2023.

Whether you call it Industry 4.0, the Industrial Internet of Things (IIoT), or Smart Manufacturing, the technology wave has been nothing short of revolutionary and today’s manufacturers understand that its adoption is key to staying ahead of the curve.

While specific results will vary, the data consistently demonstrates that investing in smart manufacturing technology yields measurable and sustained production and profitability improvements.

According to an article from McKinsey & Company: Capturing the True Value of Industry 4.0, when successfully implemented, advances in data and analytics, AI, ML, and similar technologies deliver substantial returns. “Across a wide range of sectors, it’s not uncommon to see 30% to 50% reductions in machine downtime, 10% to 30% more throughput, 15% to 30% labor productivity improvements, and forecasting that is 85% more accurate.”

Actionable Insights without More Data

The good news is that the advent of manufacturing technology like real-time monitoring has given organizations access to more information and options than at any time in history. The bad news is that decisions and subsequent improvement initiatives are often delayed by sifting through and analyzing mounds of data. This makes it increasingly important to dive deeper beyond simple charts and graphs to the source of truth. Data doesn’t lie.

Responsiveness is the key to business, and just as Industry 4.0 is constantly evolving, so too are its technologies. At Worximity, we’re closing the loop between acquiring and measuring production data, then using that information to drive improvement. Our software transforms key metrics from the shop floor into concrete improvement opportunities prioritized according to the highest impact on the bottom line. This means providing businesses with a more comprehensive solution that goes beyond just real-time monitoring.

What’s more, Worximity provides an understanding of, not only which actions will deliver the fastest and biggest ROI, but the exact order in which issues should be addressed. According to Worximity founder, Yannick Desmarais, these enhancements stem from the company’s ongoing quest to provide manufacturers with even more value, detail, and responsiveness.

“Corporate management must have the information to make decisions that are best for the company as a whole – not a particular facility, line, shift, or machine. And for those overseeing multiple plants, the sheer volume of data can be overwhelming. Decision makers must have actionable data without relying on a team of analysts to provide it.”

And this is just the beginning. Desmarais explained that developers are working toward providing customers with the ability to simulate the impact of decisions on the company.

“Imagine that a manufacturer cuts its costs to win a large contract or is in jeopardy of losing a customer. Our system will be able to accurately forecast the impact of winning or losing a contract throughout the company and how that translates into the bottom line.”

Delaying the Inevitable Will Only Cost You

Smart manufacturing is changing the manufacturing landscape. It may even be fueling the success of your biggest (or soon-to-be biggest) competitors. But it isn’t a silver bullet. Results hinge on the collection and analysis of multiple data points and putting off implementation only serves to delay improvements.

“Leveraging historical performance to understand long-term trends is critical to making improvement decisions,” said Desmarais. “This requires a minimum of 300 data points by category. Which means delaying any investment in smart manufacturing technology will put you years behind those who invest now.”

Each day lays new challenges on the lap of food and beverage manufacturers like yourself. While some are circling the wagons, others see this as an opportunity to build resilience and put themselves in a position to implement the next generation of this evolving technology – all while gaining the confidence of consumers and investors alike.

Learn more by watching a 3-minute demo of our software.